- Market-Inspector.co.uk

- Blog

- Facts about Small & Medium Businesses in the UK

Essential Facts You Should Know about SMEs in the UK

Statistics show that Britons are establishing more and more enterprises each year. In 2016 alone, there were 5.5 million private sector businesses, up by 97,000 since 2015. One of the reasons for that include increase in granted business startup loans and grants. Positively contributing to that activity is also bigger support from the government side with government backed business loans.

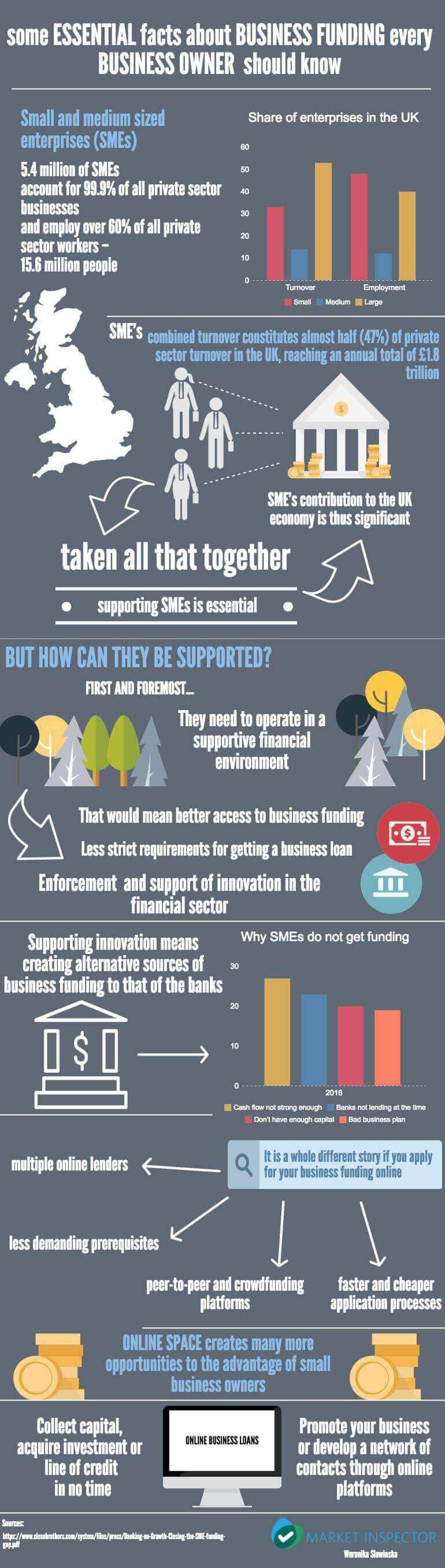

The vast majority of businesses in the UK are small and medium businesses, which are usually ventures with fewer than 250 employees, according to European Union standards. Those companies, either at the beginning of their journey, or in the middle of it, are often faced with a need for funding. Given their size and how well-thought-out their business plans are, acquiring business startups loans and grants can often be difficult.

Over the past three years, 60% of SME businesses sought some form of external funding. This would include business startup loans or government backed business loans. Although reasons for seeking funding vary, in most cases, it is to start and grow a business, gain working capital or to purchase assets.

Startups and small businesses tend to turn to banks and governments to acquire business startup loans and grants. However, applying at those institutions is a rather complicated and long process, where requirements can be unearthly.

Adding to that, further technological progress and the aftermath of the 2008 financial crisis left the financial sector unstable. More importantly, it changed how people perceive banks. From being trusted institutions with a reputable reputation, banks became untrustworthy. However, banks also became more cautious by mainly focusing on providing secured business loans. That was the time where online lending and multiple alternative lenders entered the financial arena. Business startup loans and grants became more accessible through online lending.

Offers and opportunities flourished and small business owners now have the opportunity to acquire business loans online through peer-to-peer platforms, which quickly became extremely popular as an attractive source of business startup loans and grants.

The Role of Startups and Small Businesses in Today’s Economy.

Talking about financing startups and small businesses, we cannot underestimate their importance in today’s economy. As their prosperity and existence is a product of many things, and involves many stakeholders, we need to look at it from a more holistic approach.

In this specific example, an essential role is played by the banks and governments. These two institutions steer the direction in which business owners can go. Although separate entities, incumbent banks and governments have much in common. No other financial institutions or company has as much to say in the politics as banks do.

Without drifting too far from the focus of this article, it is recommended to understand the current position of the UK government when it comes to supporting SMEs and startups.

The government pretty much determines what are the opportunities and limits when it comes to starting a business and further getting a funding for small business.

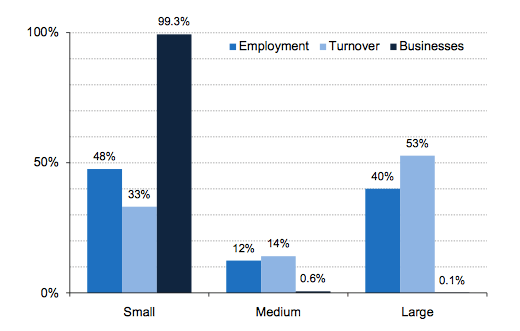

It should be kept in mind that small companies play a significant role in the growth of the economy. First and foremost, they create jobs. In the UK alone, they account for 99.3% of all private sector business at the start of 2016, and 99.9% were small- or medium-sized. Total employment in SMEs however was 15.7 million; 60% of all private sector employment in the UK. In comparison, there are between 25-27 million small businesses in the U.S. that account for 60% to 80% of all U.S. jobs.

On the other hand, small businesses and startups positively contribute to the growth of innovation. More importantly, they spur competition generating new metrics of doing business. The best example are so-called digital/innovation disruptors like Uber, Airbnb or Funding Circle who shook up their respective industries and created new ground for competing and building businesses.

If we take, for example, the financial sector, the implications of the 2008 financial crisis contributed to the rise of financial technology startups. The financial crisis left people distrustful towards incumbent banks and FinTechs quickly picked up on that.

Today, the financial sector is flourishing with new solutions and innovative ideas bringing more opportunities to everyday people and making funds accessible to many more.

What is the role of the government in all of this? Essentially, it is the government’s task to facilitate by creating a supportive environment where innovation and entrepreneurship can flourish. Moreover, smart regulations and tax structures should be in place to make life of the entrepreneurs easier. Providing the right climate for the startups to succeed also includes access to capital and business advisors.

If we take a closer look at business startup loans and grants, we might see an increase in activity of the UK government in the FinTech sphere. The government has a record of encouraging growth in the domestic FinTech industry. The number of FinTech investments in the UK is one of the biggest worldwide. Although China is the leader when it comes to investment, the UK became the most prominent hub for FinTech players.

Why is it Essential to Support SMEs With Business Startup Loans and Grants?

Supporting growth of SMEs and startups is essential for the economy of the country in the pursuit of innovation and progress. SME’s combined turnover constitutes almost half (47%) of private sector turnover in the UK, reaching an annual total of £1.8 trillion. What the government should do is to create an environment where those companies can thrive and evolve. Thus, the financial support is crucial. This may have its reflection in government backed business loans, but also in a bigger need for business startup loans and grants.

The government could potentially cooperate with banks and financial institutions to facilitate lending processes. This could be done by creating more realistic requirements when it comes to applying for business startup loans and grants. Government backed business loans should also be more prevalent and programs like startup accelerator or incubators promoted.

If you would like to use this infographic on your website, use the embed code below:

Sources:

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/559219/bpe_2016_statistical_release.pdf|

https://www.fsb.org.uk/media-centre/small-business-statistics

https://www.closebrothers.com/system/files/press/Banking-on-Growth-Closing-the-SME-funding-gap.pdf

http://blog.floatapp.com/5-reasons-to-seek-business-funding/

http://www.nbcnews.com/id/45996365/ns/business-small_business/t/how-many-jobs-can-your-startup-create-year/#.WQh02omGP_Q

We strive to connect our customers with the right product and supplier. Would you like to be part of Market Inspector?