Get up to 4 quotes from our selected suppliers by filling in only 1 form

Save money by comparing quotes and choosing the most competitive offer

Our service is 100% free and with no obligation

- Market-Inspector.co.uk

- Merchant Accounts

Merchant Account

What Is a Merchant Account?

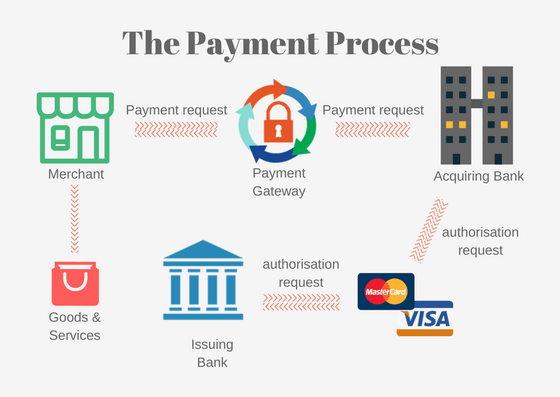

A merchant bank account is a financial service that provides the connection between the acquiring bank, the merchant and the merchant service provider. A merchant account enables businesses to legally accept payments from cardholders via credit or debit through a secure channel.

Different from normal bank accounts, a merchant account is a holding account that captures all information about the transactions, and the funds itself. For any company that accepts credit card or debit card payments, it is a place where the money first lands.

Thereafter, the funds are deposited to the regular bank account when the payment is verified. Simultaneously, payment gateway acts as a link between a merchant account and the customer’s bank account through which a payment passes.

- How Does a Merchant Account Work?

- Why Does Your Business Need a Merchant Account?

- Advantages and Disadvantages of Merchant Accounts

- Merchant Services in the UK

- Merchant Service Providers in the UK

- High-Risk Merchant Accounts

- What is a Merchant Account ID?

- Merchant Account Fees

- How to Open a Merchant Account in the UK

How Does a Merchant Account Work?

The bank issues a credit or debit card to a cardholder for shopping purposes. With each transaction, a payment request passes the payment gateway to the bank.

The bank then sends the request through the relevant card scheme, e.g. Visa & Mastercard for authorisation. When approved, the merchant bank account holder can complete the purchase.

Why Does Your Business Need a Merchant Account?

Due to the revolution brought on by innovation and new arising technologies like smartphones, e-commerce growth, and Omni channelling, retailers nowadays have to adapt to the enormous changes and provide multiple payment methods.

E-commerce is booming and the consumer demand is driven by personalisation and convenience. Considering these major shifts, merchant accounts provide an opportunity to effectively influence the customer’s entire shopping experience through an online merchant account.

An online merchant account allows your company to receive payments over the internet. Whenever customers make an online payment for your goods or services, this bank account will help to make the payment go through in a smooth and secure manner.

It is issued by a bank or a Payment Service Provider (PSP) that controls the online money transfers coming in. You cannot access or transfer money from that account, but instead, the money received from online payments gets redirected to your regular account when it is fully processed. It is the bank’s, or the PSP’s, job to make sure all the funds are transferred to your account correctly.

Advantages and Disadvantages of Merchant Accounts

Merchant accounts provide an opportunity to get valuable insights into consumer behaviour. The business can thereby provide tailored services and personalised solutions to each need, as well as enhance their CRM systems and create relevant content.

As many of you surely have experienced with your own business, there are always pros and cons when it comes to a committed contract with another company. Considering merchant accounts, however, the following bullet points clearly outweigh the cons.

Pros of Having a Merchant Account

As mentioned above, merchant bank accounts offer an opportunity to legally accept credit or debit card payments through a secure channel. The process involves several requests and will first be authorised after collecting and analysing essential funds from the bank which issued the card.

Additionally, all participants must play by the regulations set up by the card associations, such as Visa or Mastercard. This system enables merchant account holders to complete transactions with unfamiliar cardholders without exposing themselves to any risk.

As credit card orders are larger in number than check and cash orders, merchant accounts become a cheaper option to complete transactions. The risk of employees giving out the wrong amount of change decreases, checkout lines become faster and an increase in sales are some of the improvements that you will begin to notice with a merchant account.

On top of that, investing in a card payment machine for your small business can further reduce your operating costs. It is important to do your research to find the type of card reader your business needs most, for example, mobile card machines could be a great option for restaurants and cafes.

Moreover, with a merchant account, in-house operations also get easier, because the archived transactions make it easy to keep track of bookkeeping. It goes even further as this bookkeeping can be used for CRM systems, payroll services and many other business operations.

- Safe payment option

- Protection of sensitive data

- Increased sales

- Prevention of fraud

- Enhancement of customer shopping experience

Cons of Merchant Accounts

Unfortunately, the risk of fraud in online businesses is still a reality. However, due to new technologies and tightened regulations, such possibilities become more and more rare nowadays.

In addition, credit risk is always present in the online market, especially for online retailers. Customers pay you in advance for the service or goods you provide. It is your responsibility to deliver a prepaid product or service. Failing to do so can lead to dissatisfied customers and extra fees for chargebacks.

Financial stability is another key aspect of the risk involved. Most providers base the fees they charge you on the financial credibility of your business. The better your finances, the lower the fee. Decreasing financial stability might result in higher costs for a merchant account.

When applying for a merchant account, the companies are evaluated amongst others on how well established they are and if doing business will bring both parties any profit. There are certain businesses, the so-called ‘high-risk’ businesses which may have a hard time finding a merchant account provider.

- Risk of fraud

- Credit risk

- Risk of damaging financial stability

- Difficulties finding a merchant account provider

Merchant Services in the UK

Merchant account services are mostly known under the term ‘credit card processing’. The service enables businesses to accept payment through a secure channel by using the customer’s debit or credit card.

The options of payment processing expand constantly along with innovative technologies. The term ‘merchant service’ nowadays defines a broader range of payment options, such as:

Debit and Credit Cards

The most popular payment method amongst consumers is debit and credit. Due to arising technologies, however, there is an increasing possibility of mobile payments replacing physical cards over time.

Payment Gateway

The payment gateway processes payments from customers that are doing a transaction on a website. This type of online merchant account service enables e-commerce businesses to receive the necessary authorisation for card payments through a secure channel.

An online merchant account and payment gateways are interdependent. For the money to securely reach your bank account, the payment gateway first needs to send secure information to the relevant parties. Payment gateways are provided by a third party.

POS - Point of Sale

In retail stores, it is commonly known as the checkout point, POS covers all software and hardware that make it possible to accept payments via credit card terminals and cash registers. Most of them have touch screens with innovative programs that enable the cashiers to get accurate product and price information in order to complete a transaction more smoothly.

ACH - Automated Clearing House

This merchant service gives customers the opportunity to make a payment without having to use a physical credit/debit card, or a physical check.

Mobile Payments

Mobile payments are a convenient payment method, where the customer just needs to utilise a PIN, instead of entering the whole credit card information each time.

Loyalty Programs

Loyalty programs are an easy and efficient way for a merchant account holder to maintain a good relationship with their customers. The program rewards consumers with club cards or special discounts for making their purchases in their business and being loyal to their brand.

Merchant Service Providers in the UK

There are many players in the payment processing industry in the UK. Each of them provide multiple services with a wide array of features and highlights. With so much information online, it can be quite overwhelming to compare different merchant service providers and make informed decisions. The following companies are the most popular players in the UK. Check the table below to get further information on their offerings.

| Company | Service Highlights |

|---|---|

| Largest merchant service provider in the UK Tailored service Provides services for all sizes of businesses Live customer service |

| No monthly fees £29 + VAT card reader Live customer service 1% to 2.75% per transaction |

| Competitive rates Live customer service Simple pricing policy No joining fees |

| Live customer service Provides merchant services for high risk businesses Specialised in E-commerce merchant accounts |

| UK-based banking partner Customised pricing Serves UK businesses of all sizes & types Live customer service |

| Wide variety of products Customised pricing Live customer service Partnerships with First Data and AID |

| Over six million clients UK-based customer support Competitive rates Live customer support |

| £27 / month Free setup Mobile device compatible Brand customisation |

| Provides merchant account with payment gateway services Starting at £19 2,49% + £0,15 per transaction Free additional services |

| Starting at £20 / month Ability to scale up and down Availability of other business services such as payroll services |

| No setup or monthly costs Wide variety of compatible merchant accounts and currencies Starting at 3.4% + £0.20 to 1.9% + £0,20 per transaction |

High-Risk Merchant Accounts

As mentioned above, it is essential for both the business and the merchant account providing company to ensure that both companies are well established and that doing business will bring profits for both participants.

There are certain types of companies that are considered riskier than ‘traditional businesses’. If a business is classified as ‘high-risk’, it is most likely due to the industry the company is operating in.

High-risk merchant account providers serve businesses such as:

When a company is marked as high-risk, it will be more difficult for them to connect with a company that is willing to provide them with a merchant account.

Nevertheless, there are various merchant service providers that are specialised for these types of businesses. High-risk businesses still have the ability to accept credit card payments and operate just like any other company.

However, there is a great chance that banks will demand more background information and financial statements before actually agreeing on setting up a merchant account.

Additionally, there might be differences in the processing rate. Whilst having an agreement with a high-risk business, merchant account providers expose themselves to a higher risk than with traditional businesses.

When the merchant account holder can provide a positive processing history of at least 6 to 12 months where the percentage of chargebacks and refunds remains fairly low, there is the chance for the business to be reclassified as low-risk.

What is a Merchant Account ID?

A merchant number ID is set up explicitly for each merchant account and will be assigned from every bank, no matter where the merchant account is held. The ID consists of a sequence of numbers, which allows banks & credit card institutions to identify all businesses.

The ID is fundamental in order to accept credit card payments on behalf of the merchant account holder. In order to receive a merchant number, the bank must first be convinced that the applicant is trustworthy.

Merchant Account Fees

After a merchant service provider accepts a business as a merchant, the holder of the merchant account needs to pay the account setup fee. Commonly, this fee differs from several hundred to thousands of pounds.

Merchant accounts often have many types of merchant account fees, which can be confusing. These fees vary greatly depending on the service provider. While they should not be the main ruling factor in choosing a provider, it is still strongly advised to get a clear understanding of certain costs before making a commitment.

Transaction Fee

A transaction fee is charged per transaction, whether the payment is approved or rejected by the card-issuing bank. Depending on the type of transaction, there are different fees set. Transactional fees appear as the biggest cost of maintaining a merchant account.

For credit card transactions, the fees tend to lay between 0.5% and 4% on average. When it comes to debit card transactions, the fee is between £5 and £50. In case of a chargeback or refund, the company can expect a fee of up to £12 - £20 per matter.

Flat Fee

Flat fees are sometimes charged on top of transactional fees. It depends on the agreement with your bank about how high these fees are. For most merchant accounts these fees are charged according to credit card terminal use, but with an online merchant account, they are linked to the payment gateway. Flat fees are usually a fixed fee of roughly £0.10 - 0.30 per transaction.

Incidental Fee

Incidental fees are only charged per incidence. For instance, in case of a chargeback or a refund, you have to put a chargeback fee into account. In case there are any chargebacks, the merchant won’t get charged by the merchant service providing company.

It is strongly advised to keep track of the fees, as there are more than just chargebacks that are classified as incidental fees.

Terminal Fee

These fees are charged from merchant accounts that are set up for physical retailers, where customers swipe their cards at a terminal. Merchants with online merchant accounts, don’t have to take the above-mentioned fee into account.

Annual Fee

Annual fees are charged each year to cover the basic use of the service. Some merchant account providers don’t charge an annual fee.

Early Termination Fee

An early termination fee is charged in case the merchant cancels the contract earlier than expected. In other words - another unnecessary fee that one might want to avoid.

Monthly Fee

These fees are charged per month, commonly in order to cover call centre costs. The prices can differ on average from £5 - £40.

Transaction Volume Limits Fee

A majority of merchant service providers set a minimum monthly fee, which means that the account holder needs to reach a minimum amount in transaction volume every month. If the business does not reach a certain amount, the provider will charge a fee to cover the difference.

For instance, if the merchant account provider sets a minimum of £150 and the merchant makes only £100 in card transactions in a month, the merchant needs to make up for the difference and pay the provider £50.

How to Open a Merchant Account in the UK

There are two ways to obtain a merchant account. You can go directly to the bank, or consult with a Payment Service Provider (PSP). In both cases, you will need to undergo a screening process to exclude any risks. Therefore, when a business applies for a merchant bank account, each application goes through a variety of processes. In case the merchant service provider agrees to set up a merchant account with a business, it can take up to 1-7 weeks.

Your bank can provide you with a merchant account, however, you will have to secure a payment gateway provider to be able to use that account. Many third-party gateway providers let you choose your own bank to partner with.

Another way is to go to a PSP, which can set up a merchant account for you with a preferred bank. Then your merchant account is then automatically linked to their secure payment gateway solutions. In both cases it is wise to carefully consider requirements and fees.

It is important for applying merchant to ensure that the merchant service provider understands their business model. The application undergoes a thorough KYC analysis, including any relevant information to the screening process.

Another very important fact that companies providing merchant accounts focus on, is: Who are the people that own the business? Everybody on the board of directors and everybody who holds ownership in the company will be screened in terms of:

Besides the directors of a business, the business model itself will be analysed as well. In terms of e-commerce, the company applying for an online merchant account will be analysed on if the website exists and if the URL is directed to what it should.

We strive to connect our customers with the right product and supplier. Would you like to be part of Market Inspector?

- What Is a Merchant Account?

- How Does a Merchant Account Work?

- Why Does Your Business Need a Merchant Account?

- Advantages and Disadvantages of Merchant Accounts

- Merchant Services in the UK

- Merchant Service Providers in the UK

- High-Risk Merchant Accounts

- What is a Merchant Account ID?

- Merchant Account Fees

- How to Open a Merchant Account in the UK