- Market-Inspector.co.uk

- Merchant Accounts

- Contactless Payment

Contactless Payment for Your Business

How Does Contactless Payment Work?

Contactless payment offers a secure method to pay for goods and services. Using either debit or credit cards with RFID technology, or mobile phones using near-field communication (NFC), a customer can complete a payment in a few seconds.

Most mobile card machines nowadays have a contactless payment feature, and this typically comes in a standard package offered by merchant account providers. There is a chip inside the device that emits radio waves that are then read by the contactless payment machine.

In order to carry out a transaction, a customer simply needs to hold the payment device close to the RFID reader on the card payment machine, which then picks up the signal and processes the payment. On a debit or credit card, contactless capability is usually signified with an icon of four curved lines.

When making a payment, the transaction can either be deducted straight from a bank account, or from a prepaid account. If you are a restaurant, bar, or shop owner, then contactless payments are an easy way to offer customers a quick and secure payment process.

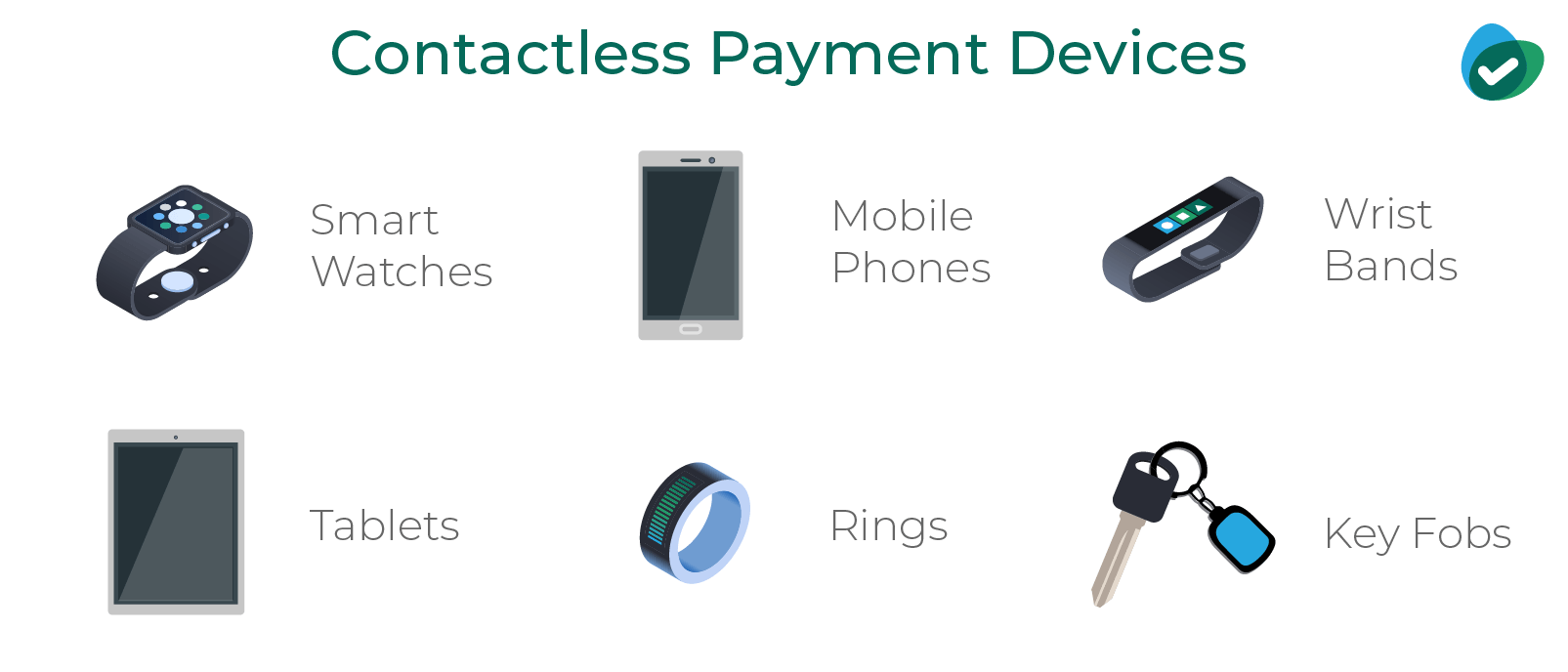

Devices You Can Use Contactless Payment with

There are several devices you can use to make contactless payments with. Card payments are the most common type of contactless, followed by mobile devices and smartwatches, which require a mobile wallet.

Contactless payment transactions are possible across the country, with most ePOS systems updated to accept this kind of payment. Currently, more than 400,000 outlets accept visa contactless payments, and approximately 63% of people in the UK use contactless payment methods.

The RFID technology of contactless can be installed in various other devices, including fitness trackers, watches, wristbands, key fobs, and even rings. This can help make your business modern and adaptable to customers’ needs.

What Is the Limit for Contactless Payment?

There is no daily limit on how many transactions can be made using contactless, but there is a £30 spending limit per payment for contactless. If the amount exceeds this, then consumers simply have to use their cards as a chip and pin solution.

However, if you are carrying out a contactless payment by mobile phone, then there is no payment limit. For transactions above £30, a two-step verification process is required, which is typically in the form of a fingerprint ID or PIN code to unlock your phone.

A receipt will not be automatically printed for purchases under £30, but rather has to be requested. With purchases over £30, on the other hand, a merchant is required to automatically provide a receipt.

If there is no money on the card, then the debit or credit card will be charged in the same way that any other transaction would. It can also result in a contactless payment being declined.

There is currently no country-wide minimum spending regulation in place, as each card network (American Express, Diner’s club, etc.) sets their own minimum transaction limit.

Minimum limits are set by some merchants, because they have to pay a fixed percentage of the payment (of every transaction). Therefore, having a customer use contactless for a very low purchase can become costly for merchants. In addition, printing receipts for low transactions can be seen as adding to these costs.

How to Use Your Mobile Phone for Contactless Payments

With the UK heading towards a cashless future, and a rapid development in contactless technological development, it is no surprise that contactless payments by mobile phones are also on the rise.

The technology used in mobile contactless payments is slightly different to that used in credit or debit cards. It uses a technology based on RFID, namely near-field communication (NFC) to transmit data.

When using your mobile phone to make contactless payments, you have to first set up your mobile wallet by installing the contactless payment app, setting up your credit or debit cards, and then verifying that you are, in fact, the user. This constitutes as the first verification step.

Then, when making a payment, a second verification step is required. Namely, to unlock your phone with either a biometric ID or a code.

Mobile contactless payments are secure, because the card number is not stored on the apps themselves. Instead, a virtual account number is created, which represents the user’s account information, thereby keeping the actual credit or debit card number private. A one-time security code is sent instead of the card’s or user’s details. This security measure is called ‘tokenisation’.

Most modern smartphones have NFC capabilities, as there is an NFC chip installed in the battery.

Currently, the three biggest mobile contactless providers on the market are Apple Pay, Google Pay, and Samsung Pay. Market Inspector has conducted a side-by-side comparison of the features these digital wallet services offer.

| Features |  |  |  |

|---|---|---|---|

| 2nd step verification process | FaceID or fingerprint ID | Fingerprint ID, PIN code, pattern, or password | Fingerprint ID, iris scan, or PIN code |

| How it can be used | NFC terminals, in-app, and web purchases | NFC terminals, in-app, and web purchases | NFC terminals, magnetic stripe or EMV terminals, and in-app purchases |

| Digital wallet cards | Credit cards and debit cards | Credit cards, debit cards, and loyalty cards | Credit cards, debit cards, and loyalty cards |

| Supporting UK banks | View the updated list here | View the updated list here | View the updated list here |

Apple Pay

Apply Pay is one of the biggest digital wallet service providers, created by Apple Inc. Through Apple Pay, you can make payments either in person, on the web, or through iOS applications.

Any Apple device that has an NFC chip in it, can be used to make contactless payments: iPhones, Apple Watches, iPads, and Macs. Apple Pay is compatible with any kind of contactless-capable POS terminal, and does not require a dedicated Apple Pay terminal.

In order to make use of Apple Pay, a user needs to set up their debit or credit cards in the iOS ‘Wallet’ app. The ‘Wallet’ app can also double as a place to store flight tickets.

This form of contactless payment is very secure, as Apple makes use of their fingerprint ID functionality for their two-step authentication. As a customer makes a payment, their fingerprint is required in order for the transaction to be processed.

Google Pay

Google Pay is the digital wallet platform and online payment system created by Google, and is essentially the Android version of Apple Pay.

Formerly known as Android Pay, Google Pay is now a combination of Android Pay and Google Wallet.

Just like Apple Pay, Google Pay enables the processing of contactless payments, using NFC technology. Similarly, there is a two-step authentication process with the use of a biometric ID (depending on the smartphone – it could be a fingerprint or iris-scan), or a passcode.

Google Pay has an additional feature that Apple Pay does not, and that is the ability to store loyalty cards in the digital wallet.

Samsung Pay

Another notable digital wallet provider is Samsung Pay, which is an alternative to Google Pay for Samsung smart devices.

Unlike Apple Pay and Google Pay, Samsung Pay can not only make contactless payments using NFC technology, but it also uses magnetic secure transmission (MST). In essence, it means Samsung Pay is accepted more broadly than the other two digital wallet providers, because MST is the same technology as the magnetic strip on debit and credit cards.

Therefore, if a POS terminal is an older model and does not have NFC technology, then Samsung Pay can still be used by holding it near the magnetic strip reader on the terminal – where a customer would normally swipe their credit or debit card through.

In addition, the Samsung Pay app can also be set as the default app for contactless payments on Android (instead of Google Pay). It can store loyalty cards too.

Using Contactless Payment on the Tube

Transport for London (TFL) has embraced the use of contactless payment to make commutes more efficient. The two most common ways for contactless payments on TFL is with an Oyster card or with contactless credit or debit cards.

An Oyster card is an example of a stored-value card (SVC) and makes use of RFID technology. An SVC is considered secure, as it stores money on the card directly, rather than connecting to an external account. This way, personal data is more secure. However, in case of loss or theft, the money is essentially lost.

Using a contactless credit card, on the other hand, ensures that a commuter does not need to spend time on topping up their card before a journey, therefore reducing queues and transit times.

With contactless payment on TFL, a traveler simply needs to tap their card on the reader, and the appropriate fare is automatically deducted. The transaction is processed immediately, and incurs no extra costs.

Any Visa, Mastercard, American Express, or Maestro card that has a contactless symbol on is compatible with the contactless payment system on the tube or bus. There is no need for any set-up process. However, overseas cards may incur a surcharge.

If travelers wish to pay contactless with their mobile phones, this is also possible, provided they have set up their digital wallets already.

Are Contactless Payments Secure?

Contactless is a secure way of processing payments. An overview of the security measures of contactless payments can be seen below:

- A contactless chip must be very close to a terminal

- Anti-collision feature in case there are multiple cards near a terminal

- Maximunm spending of £30 with debit and credit cards

- Tokenization with mobile contactless payments

- Two-step authentication requirement for contactless payments with mobile phones

- Data encryption and protection with a digital signature

A card holder’s personal data is kept private through the process of ‘tokenisation’. The contactless app generates a virtual account number, which is what the terminal recognises instead of the card details.

As each transaction has a dedicated one-time electronic signature, contactless payments security is very high. Most payment terminals, like the card machines by iZettle, SumUp, or Square, have advanced security measures in place.

Furthermore, a contactless credit card or smartphone must be very close to a terminal in order to be read. The contactless payment device has to be less than 10 cm away, and sometimes even less than 2 cm.

Some people may fear that contactless functionality means that a thief can easily hold a reader close to their card and ‘stealing’ money, but this is not possible for two reasons: you have to be extremely close to the card to process a payment, and one needs a retail account to be able to receive money through a card payment.

In addition, the person will be asked for a PIN code after repeated payments. Therefore, only a limited number of payments can be made without a two-step authentication with a credit debit card.

If a contactless mobile phone gets lost or stolen, no unauthorised payments can be made, as a biometric ID scan or a passcode of some sort is required before any payment is made.

Finally, the anti-collision feature with contactless credit cards prevents two cards from being charged for the same transaction. If two RFID or NFC-enabled cards are within the same distance of a contactless payment machine, then either only one payment will be made, or the entire transaction will be cancelled.

If, on public transportation, both an Oyster card and a contactless credit card are in a wallet, then the Oyster card will typically take priority and be charged.

Find the Best Contactless Card Reader for Your Business

In order to stay ahead of the competition, it is important that your business can offer the ease of processing payments that contactless offers. It is not enough to simply have a card payment machine, but this machine should also accept contactless payments.

We strive to connect our customers with the right product and supplier. Would you like to be part of Market Inspector?