- Market-Inspector.co.uk

- Merchant Accounts

- Payment Gateway

Best Online Payment Gateways for SMEs

What Is Payment Gateway?

A payment gateway is an online software application that helps your business execute online and offline money transactions. The main purpose of a payment gateway system is to execute money transactions, ensuring that your customers’ sensitive data remains safe.

It can be used in any type of payment, but it is mostly used for online payments that use credit cards in order to protect customers’ sensitive data, such as personal information, PIN, IBAN, etc. Therefore, a payment gateway system is the intermediary between your customer and your merchant account/bank.

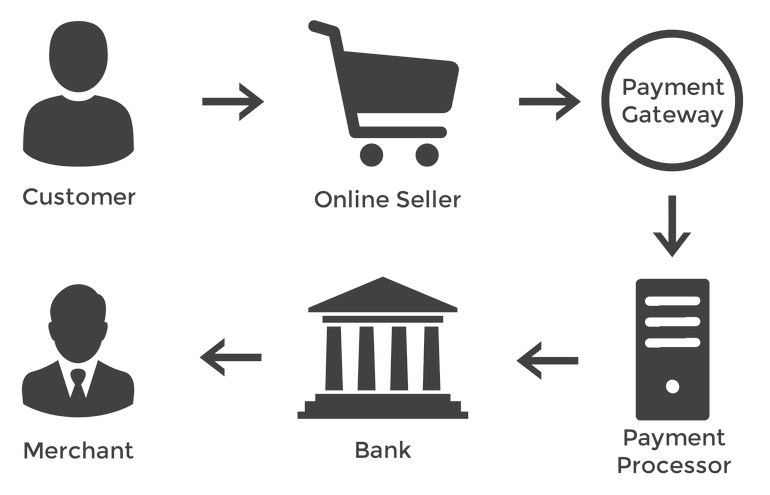

How Does a Payment Gateway System Work?

When a customer places an order the next step is to provide information about their bank and credit card. After completing this step, the e-commerce platform sends the sensitive data to the payment gateway system. There, all of this data is encrypted and encoded for security purposes.

After that, all the encrypted data is sent to your merchant account/high risk merchant account, where it will be processed. The payment gateway software then sends the website’s e-commerce system approval/decline receipt.

The whole process takes only 3 seconds, so your customer’s purchase is fulfilled very fast and with the utmost security.

Why Should Your Small Business Use a Payment Gateway System

Today, most of the purchases are done via Internet. Many businesses are building their website in order to cater to their customers’ needs. On the other hand the customers are always worried about the safety of their sensitive data. So, it’s essential for your business to have a safety system in place. In this way you are increasing the overall safety of your website, as well as, gaining your customers’ trust.

Another reason that your business should start using a payment gateway system is that you will become more flexible concerning your money transactions. Payment gateway software can be used in both online (ecommerce platform) and offline payments (ePOS system), giving your customer the flexibility to use many alternative ways in order to pay you. This Allows you to expand your business into foreign markets with ease.

Furthermore, all the payment gateway systems provide you information about your business’ transaction. This way, you can manage and control every aspect of your business as well as see the growth and the progress of your company. Hence, with this data you can optimise your future investments.

The use of a payment gateway system in the UK is widespread, so it is important to keep up with the competition.

Payment Gateway Fees & Providers in the UK

Of course if you want all the services mentioned above you have to take into consideration how much a payment gateway account will cost you. Mentioned below are some of the most popular payment gateway companies in the UK to consider. There are four main factors to keep in mind before choosing your payment gateway provider:

| Provider | Monthly Fees | Fees per Transaction | Set up Fees | Number of Card Types |

|---|---|---|---|---|

| £0 | 2.9%+21p | £0 | 9 |

| £0 | 2.9%+21p (in U.S.A) 1.4%+20p (in EU) | £0 | 6 |

| £19 | 1.9%+10p | £75 | 4 |

| £17 | 15p | £34 | 3 |

| £0 | 1.9%+26p | £0 | 3 |

| £19 | 350 Free then 9p | £0 | 30+ |

This table displays only some of the most Important providers in the UK. It is not made to promote any specific company and does not imply our cooperation with them or their services.

What Is the Difference Between a Payment Gateway and a Merchant Account?

At first we have to clarify that we are talking about totally different things. A merchant account is similar to a bank that provides the possibility to execute monetary transactions by using different types of cards (debit or credit). So, if a customer pays by card, the merchant account is responsible to handle the payment procedure and transfer the money from your customers’ bank account to your business/personal bank account.

Having an online merchant account is essential, especially if you have an online business as all the payments are executed online. As mentioned before, a payment gateway is a software that is responsible to encode all your customers’ sensitive data. Thus, we can say that a payment gateway is the safety system between your customers’ bank account and your merchant account, that is responsible to safeguard valuable information.

In some cases, several merchant account providers are able to supply you with a packet of services that include merchant account services and payment gateway systems. Even though most of the businesses in the UK tend to separate these two services.

Is It Safe to Use a Payment Gateway?

If the question is which method of business payment provides the maximum safety, then the answer is payment gateway. Technically speaking, a payment gateway software encrypts and encodes your customers’ sensitive data using the SSL language. Hence, your customers’ valuable information is modified into codeso, which cannot be accessed by unauthorised parties.

Finally, all the data is sent to your merchant account in order to complete the transaction. In order to further secure the system, payment gateway uses PCI Data Security Standard (PCI DSS) to remain safe in any case of breach. Payment gateway is associated with the highest standards of security, which makes it an indispensable tool for your business.

We strive to connect our customers with the right product and supplier. Would you like to be part of Market Inspector?